Technology & Software Industry Reinforcing Value Chain & Stabilizing Valuations for Business Resilience

Technology & Software Industry Reinforcing Value Chain & Stabilizing Valuations for Business Resilience

Due to the deeply interconnected market, the global technology, software and web application development industry felt the tremors from the pandemic crisis. Now when the whole world is captured in COVID and the major areas of developed industries are locked down, preventive health measures are a greater priority than the custom software development, which puts the industry in a fix.

While software indices experienced fluctuations due to nationwide shutdowns and stay-at-home orders, most select indices have returned to their pre-COVID levels, as the software industry is considered a structural winner given the need for greater digital capabilities across all industries. Infrastructure, Development and ERP software segments have seen significant stock and multiple expansion due to their offering of reliable cloud-based solutions that are in high demand by a growing remote workforce. Security software is expected to see increased spending as organizations secure endpoints and rectify vulnerabilities in the public cloud.

In the mid-term, it is expected that software companies with a high degree of recurring revenue, strong profit margins and critical assets around communication, collaboration, content delivery and security to experience increased demand and usage. Valuation multiples across these offerings are likely to see significant expansion. In the long term, software valuations would remain stable due to their ability to counter significant exposure to macro-sensitive events and drive cash flow by means of flexible, recurring revenue models. M&A markets are also expected to rise over the next several quarters with an increased prioritization on critical cloud infrastructure assets and other mission critical solutions, as per industry reports.

The novel coronavirus is still wreaking havoc in all the industries globally. The business and lives of people have been impacted due to the life-threatening effects of the coronavirus. The majority of IT and Tech giants across the world have committed to giving utmost priority to public health and have made significant changes in the employee working modes. Major tech conferences and events have been cancelled or turned into digital events in the wake of the crisis.

Considering the far-reaching ramifications within manufacturing, work in the corporate and technology sector has been impacted to a great extent. Many companies in the global industry landscape have either shut their factories or banned business-related traveling. Major industry events like Facebook’s F8, Google I/O, the Geneva Motor Show and the Mobile World Congress have been called off due to the outbreak. Several organizations have also encouraged their employees to work from home to prevent further outbreak of the coronavirus disease.

Most companies already have business continuity plans, but those may not fully address the dynamic and unpredictable variables of an outbreak like COVID-19. Typical contingency plans are intended to ensure operational effectiveness following events like natural disasters, cyber incidents and power outages, among others. They don’t generally take into account the widespread quarantines, extended school closures and added travel restrictions that may occur in the case of a global health emergency.

Issues faced by the Industry due to COVID-19

Within the technology and software industry, the issues that could be faced due to COVID-19 are in the following key areas:

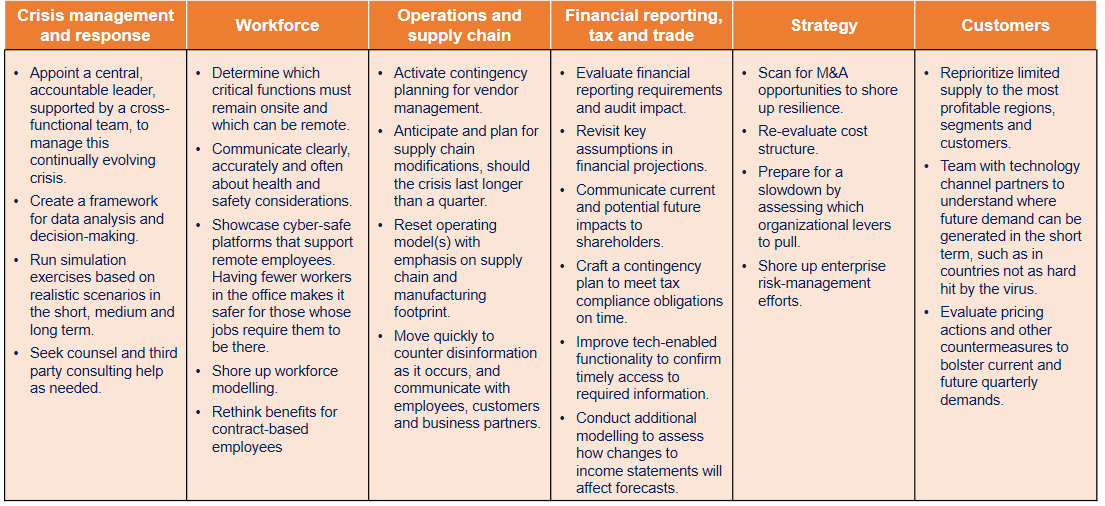

- Crisis management and response: Due to the dynamic scenario, business continuity planning does not account for the uncertainty of an evolving pandemic. Also, industry event cancellations mean fewer business development opportunities. Diminished business travel results in fewer client interactions.

- Workforce: Staffing concerns have increased for full-time employees, as well as contract workers, such as drivers, delivery workers and retail staff. A slowdown in recruiting resulting from the crisis could affect a future pipeline of skilled workers. Cybersecurity risks are likely to rise as a result of more people working remotely.

- Operations and supply chain: Global supply chain disruption would lead to production slowdown. Cash-flow challenges will test undercapitalized companies and may require alternative sourcing and the need to subsidize during the crisis to confirm readiness in its aftermath. As companies seek business solutions to address remote work, social distancing and the need for in-store alternatives, the demand for developer and engineering talent is likely to increase. Retaining top talent will be essential. Disinformation proliferates on digital platforms which would cause reputational issues for media technology platforms and communication services which would need strict intervention. Sharing economy inventory would take a hit during this period. Some component manufacturers rely on one or perhaps two main suppliers. Additional containment zones around the world trigger more shipping and delivery bottlenecks.

- Financial reporting, tax and trade: Operational, workforce and supply chain disruptions will trigger financial reporting implications in current and future reporting periods. Public companies will face increasing pressure to disclose revised guidance related to the COVID-19 impact. New state and local tax implications arise for workers who are now remote as a result of the crisis. Tax compliance operations could lag, as newly remote employees lack timely access to information.

- Strategy: Sudden or prolonged economic downturn will lead to companies considering significant budget cuts that eliminate discretionary spending. The crisis underscores the need for flexible, resilient business models, including increased focus on cash-flow forecasting and impacts on supply-chain and commercial-channel partners. Company valuations may become more attractive for acquisitions by cash-rich companies that have been sitting on the side-lines, while keeping targets in mind.

- Customers: Tech sector companies rely on overseas consumption, which has slowed since the outbreak. Customers are delaying purchases because the pandemic has exacerbated an already uncertain global economy. Technology support may struggle to keep up with customer needs on applications.

Steps to counter existent issues for business resilience and continuity

Potential Impact on Technology sub-sectors

- Hardware/software: In contrast to the parts shortage and unpredictability of supply chains concerning the hardware industry, software is a growth catalyst. Companies with remote-working technologies are already seeing increased demand as businesses increase their remote-working capabilities. Security software will see third-order benefits from a growing remote workforce. IT spending on security software will increase as organizations race to secure endpoints, particularly cloud-based tools, log management, and VPNs. Hardware companies may see major demand coming from enterprises, who are placing large orders for laptops and mobility devices to support employees now working from home.

- IT services: IT spending forecasts indicate continued demand for cloud infrastructure services and potential increases in spending on specialized software. Forecasts also anticipate increased demand for communications equipment and telecom services as organizations encourage employees to work from home, and schools move to online courses. Most organizations do not have a tech stack in place for a reliable business-continuity plan (BCP). Due to enhanced remote work scenarios, IT departments will play a larger role in future BCPs, and will need help from IT service providers in procuring devices, setting up a resilient, flexible and secure network, disaster recovery systems, IT security, etc. The need for faster access to data and automation will enhance the focus on network equipment and communications like never before, speeding up 5G network deployments and adoption of 5G equipment.

- Semiconductors: Raw-material supplies such as aluminium, copper and chemicals are affected by disruption, with delay in delivery by up to a quarter and will be difficult to re-inventory. Near-term actions are resulting in supply and fulfilment disruptions up and down the electronic manufacturing value chain. This may result in a shortage of components, creating choke points at circuit board and systems manufacturing. In the longer term, new product schedules might get delayed and product go-to-market strategies may need to be changed to meet the velocity of the value chain. Delays could result in reduced participation in customer meetings, internal meetings, and external events. In the long term, companies could be required to address the risks of geographical concentration and lack of resiliency to avoid single points of failure and limit future disruption.

- Network equipment: Increase in the use of teleconferencing software as more technology companies encourage employees to telecommute will have potential benefits for companies that have technologies already deployed in that space. Need for ever-faster access to data and automation will enhance the focus on network equipment and communications as never before, speeding up 5G network deployments and adoption of 5G equipment.

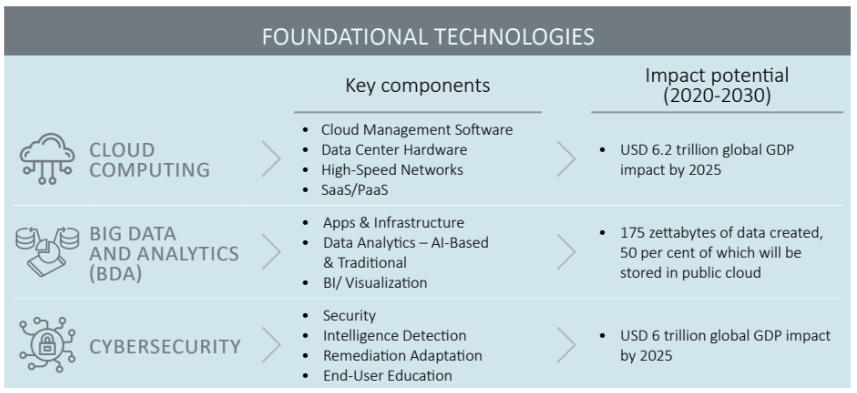

Technologies with high strategic impact potential in this decade (1/2)

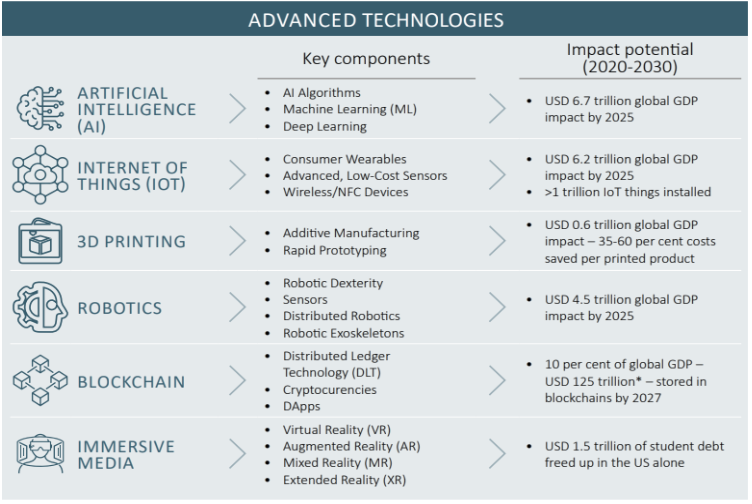

Technologies with high strategic impact potential in this decade (2/2)

How Tech & ITES could revive other impacted sectors

COVID-19 has been called a once-in-a-century event. In its wake, we are likely to see a lasting shift in employee expectations, a greater capacity to respond to sudden, global disruptions, an accelerated adoption of artificial intelligence and automation, and more automated and diverse supply chains. High tech companies that invest now in creating an Elastic Digital Workforce will be much more prepared for a post-COVID-19 world.

Technology and software solution providers could help revive severely impacted industries during this crisis by supporting in scaling and adapting to the transforming business needs. Solution providers could partner with organizational leaders, in collaboration with their respective internal IT teams, to ensure that all employees have access to, as well as the ability or proper training to use remote working tools. They could push for universal adoption and model their use. Business continuity plans should account for the Elastic capacity of a digitally enabled workforce, as well as potential reductions in workforce and travel. Powered by a strong culture, organizations can set about strengthening or replacing every aspect of their technology that could support an Elastic Digital Workforce, such as distributing the right equipment to employees. Networks that connect devices to homes where workers and customers reside must be shored up, and security protections for data flowing over those networks must be assured. Acting quickly helps to weaken the impact of COVID-19 on businesses. In fact, the positive effects of a transformation to an Elastic Digital Workforce can be felt quickly with the help of effective partnerships with the technology enablers and software solution providers.

With more people working from home, a new challenge arises in the form of cybersecurity breaches and malware attacks. Cybercriminals disguised as alarming COVID-19 news reports have also been reported, targeting the global workforce with phishing emails containing malicious software. Technology sector partners could help to reassess their security threats and ensure that their client company’s firewall, antivirus protection and other security features that demand authentication are in place to mitigate malware risks.

Also, technologies such as cloud telephony and cloud-based document sharing have made communication between teams seamless and flexible. The right tools and methodologies can help businesses keep their operations seamless. Productivity need not happen only in a brick-and-mortar office.

The technology sector has already come out in strong support to work with medical practitioners and governments to contain the Coronavirus. Several start-ups too, have deployed drones and AI- based robots for high-risk tasks, such as patrolling public places, disinfecting rooms and communicating with infected patients.

Technology will continue to thrive by lending technological support during a large-scale health crisis such as COVID-19. However, innovation will be the true game-changer.

With more people working from home, a new challenge arises in the form of cybersecurity breaches and malware attacks. Cybercriminals disguised as alarming COVID-19 news reports have also been reported, targeting the global workforce with phishing emails containing malicious software. Technology sector partners could help to reassess their security threats and ensure that their client company’s firewall, antivirus protection and other security features that demand authentication are in place to mitigate malware risks.

Also, technologies such as cloud telephony and cloud-based document sharing have made communication between teams seamless and flexible. The right tools and methodologies can help businesses keep their operations seamless. Productivity need not happen only in a brick-and-mortar office.

The technology sector has already come out in strong support to work with medical practitioners and governments to contain the Coronavirus. Several start-ups too, have deployed drones and AI- based robots for high-risk tasks, such as patrolling public places, disinfecting rooms and communicating with infected patients.

Technology will continue to thrive by lending technological support during a large-scale health crisis such as COVID-19. However, innovation will be the true game-changer.

Industry Outlook – The Indian Perspective

According to the International Data Corporation (IDC), growth in global Information Technology spending is expected to reduce by 3- 4% by the end of 2020, considering the conservative scenario due to the outbreak of Coronavirus disease (COVID-19) pandemic.

However, adoption of collaborative applications, security solutions, Big Data and AI are set to see an increase in the coming days.

Observing the scenario of Indian market, a slowdown in terms of discretionary IT spending, contract renewals and new deals getting signed as enterprises recalibrate by cost structure is expected in the short term. Existing project executions have also taken a hit due to travel restrictions in place. Companies will be forced to relook at their growth targets for the rest of the year as the impact will become evident in the next few quarters. On the other hand, it has provided an opportunity to organizations to test their resilience on business continuity, remote connectivity, and security as they look at innovative ways to service their clients. Enterprises are looking at IT vendors to handhold them in the hour of crisis.

With corporates across the country implementing alternative ways of working, it is generating a parallel corporate line that demands to be connected from where they want, when they want and to who they want. While work from home is not a new concept for Indian corporates, it certainly is a testing time to see the success at this scale. Enterprises are also exploring ways of working together that leverages conversations, meetings, and assets across platforms with employees working remotely from wherever they are located to serve customers better and ensure business continuity. The adoption of collaborative applications growing at a rapid pace after the COVID-19 outbreak is evident in the current scheme of things.

As organizations are taking preventive measures to curb the spread by encouraging their workforce to connect from home, there are different sets of challenges that the IT teams within the organization are grappling with – how to secure data and assets from cyber threats. The adoption of a zero-trust policy is expected to increase, in the months ahead, as an increasing number of people connect to work from personal networks. organizations would tend to keep their VPNs and Firewalls updated with security patches in place.

IT vendors should focus on building/improving capabilities on AI and Big Data as new challenges and use cases emerge.

While the economic impact of the COVID-19 outbreak is evident, it has provided an opportunity for Technology & software solution vendors to become more resilient and innovative. Solution vendors should look at offering incentives on the existing contract extensions and also build conversations on business continuity and disaster recovery in the cloud. Technology players should also keep an eye on emerging uses cases in AI for disease detection, tracking, and prevention. While challenging times await hardware manufacturers, it opens an opportunity for IT vendors to handhold the clients in the hour of crisis as a trusted partner and help them sail through the situation.

Reputation Challenges for the Industry

The Covid 19 pandemic has changed the way customers behave and is forcing businesses to rethink their strategy. Technology and software companies have numerous challenges to take care of; from reviving the business to ensuring that they have runway for the next 9-12 months in case the growth of the economy is slow.

Covid 19 has accelerated a lot of the key technology, business, professional and work / life related trends that have emerged. At the same time, it has exacerbated risks and threats that companies face from cyber compromises. The reputational risk profile of each business is different depending on variables including sector, size of business and varying degree of internal and external threats including the extent to which, the reliance on technology plays a role in the business.

Most cyber security or risk & crisis management plans are not formulated with the prospect that all staff would be working from home and that an incident could come at a time when the infrastructure of an IT system was overloaded and vulnerable. Many organisations have been forced to effect changes at great speed, adopting a roll out programme that otherwise might have taken months if not years to achieve, with the inevitable risk that security is compromised and there are gaps in its systems which play to third party threats. At the same time, external threats such as phishing and social engineering are on the increase as fraudsters seek to take advantage of any vulnerability in a remote working system and preying on individuals’ personal vulnerabilities.

When responding to the challenges posed by COVID-19, technology companies must be mindful that, what they do now will impact how they are viewed in the future. With supply chains under huge stress at the moment, particularly where imported products are concerned, many businesses are struggling to comply with their obligations and either supply customers or honour contractual obligations made pre- lockdown. Where this impacts consumers, disagreements can quickly escalate to a situation where customers become frustrated with the business’s inability to supply which in turn can lead to cancelled orders and negative online reviews or comments on social media, garnering unwanted publicity and influencing other consumers away from a brand towards its competitors.

Many organisations are having their company values put to the test when it comes to their actions in balancing the support and protection of staff and customers with income and profit. A communications strategy for employees, partners, suppliers, authorities and the public is key to a risk management plan.

Consocia Advisory, has been at the forefront of building and protecting organisational and brand reputation for several sectors.

We remain available to curate effective programs to pre-empt and mitigate risks through process-thinking, process-improvement and institutionalisation of best business practices, so as to anticipate risk events, minimise their impact and safeguard the overall future of the enterprise.

Cushioning the COVID impact on our clients: Consocia’s value driven services providing dynamic solutions

As COVID-19 grew into a global crisis, Consocia realized the need to support industry colleagues in dealing with the biggest challenge faced ever in recent times that of business continuity. In response to the situation, we were swift in curating an in-house crack team comprising experts in research and insights; stakeholder database generation; content; government relations and public policy.

Consocia Advisory engaged Central and State Governments besides many Districts through strategic narrative backed by data to highlight the need of the hour in the fight against the deadly pandemic. We urged immediate orders to restore Client’s ability to manufacture, warehouse, transport and distribute the client’s essential products across the country.

Presently, Consocia is working with several enterprises for business continuity as well as crisis management. In the last few weeks, we have helped opening of plants and warehouses of the Indian entity of a global disinfectant company in 6 states including in Red zones as well as

Containment areas, besides that of a renowned lighting solutions company in two states (Haryana and Karnataka) already while they are now looking for our assistance in three more states.

Within a few days of being on-boarded, through our 24×7 support, we were able to secure not only policy interventions for manufacturing but also for warehousing, logistics and distribution as well as access to staff & workers. In the process, we were able to assure the Central and State Government stakeholders that all due precautions are being taken to prevent and contain COVID 19. We even helped with internal SOPs for transportation and staff movement.

We are helping the apex body representing the Shopping Malls across India against the debilitating impact the Coronavirus pandemic has had on them. On behalf of SCAI, Consocia has crafted several interventions to draw the attention of the stakeholders and policy-makers on the plight of the industry and reinforcing reasons for Malls to be considered for resuming operations in a staggered manner, for the post-lockdown phase. At the same time, Consocia is working with the empowered Group of Ministers and Committees for COVID-19 response as well as the RBI seeking urgent financial stimulus for the sector and amplifying the initiatives through media engagement from time to time.

The upcoming editions of the dynamics of business transformation white paper series will focus on specific industries with strategies and outcome driven solutions to positively impact business outlook for business recovery and continuity in the COVID-adjusted world.

COVID-19 is a long battle for the industry. As your trusted well-wisher, our team is available to support you during these uncertain times in the areas of business continuity planning, public affairs, public policy and government relations. Contact us: reachus@consociaadvisory.com