978a6503db90b2e73e3943f2732debdd

Category Archives: Uncategorized

978a6503db90b2e73e3943f2732debdd

978a6503db90b2e73e3943f2732debdd

978a6503db90b2e73e3943f2732debdd

Blogs at Consocia

How several consumer brands have fared better in the post-pandemic era

The pandemic has proved to be the ultimate “disruptor” for the entire world. Businesses in all countries across the world are facing immense challenges due to the problems of conducting business in nationwide lockdowns and social distancing. However, surprisingly, there are several consumer brands that are doing surprisingly well in the post pandemic situation.

Sales of Tractors has gone up as farmers across the country have had to increase dependence on mechanized solutions for farming. The lack of public transportation too has added to the increase in tractor sales as tractors are being used as rural transport vehicles. Two wheelers, and small car segments have also shown growth, as many people want to shift away from their dependence on public transportation.

Many foods companies to have been doing particularly well. Parle has been adding record breaking sales and many namkeen and instant food manufacturers are enjoying great growth rates. I and my family have been experimenting on specialty cooking at home and we often swap recipes with friends doing the same. Millions of Indians now make use of many packaged ingredients to make meals at home. Manufacturers of products like herbs, seasonings, sauces and ready mixes are now having to ramp up production to meet the fast rising demands.

The online pharmacy sector is also witnessing much action now. Although the sector has been existing for a while now, there is now a huge focus on the segment with large and small players entering the segment. Customers are demanding delivery of medicines at home and more than willing to go through the online process of uploading their prescriptions in order to get the delivery of medicines at home. Operating in a similar space, online medical testing and medical consultation apps like Practo, Credihealth and Lybrate are now witnessing a huge surge of sign ups as customers want to avoid the risk of going to hospitals and clinics and want to take advice from doctors online especially for not so serious ailments.

Adding on to this, medtech companies have played a crucial role in cushioning the impact of COVID. Customers are buying equipment for home use directly from med tech companies. The new slew of med tech products aimed at home users of digital infra-red thermometers, oximeters are an addition to homes where there is a suspicion of infection or even as a precautionary measure.

The digital education space is witnessing one of the most exciting of phases. Several online learning companies like Toppr, Vedantu, BYJU’s, Whitehat Jr, Unacademy, are showing rapid growth and enrollments have surged almost trebled for the sector since the first phase of lock down in March 2020. These companies are expected to have a record year due to the physical shut down of all the educational institutions like schools, colleges, universities and coaching centers in the country. These companies have adopted aggressive customer communication campaigns to take advantage of the situation.

The online grocery segment is witnessing massive action. Many of them like Big Basket, Grofers, Milkbasket have seen a sharp jump in deliveries. So lucrative is the growth in the category that other ecommerce players are jumping into the fray. Walmart backed Flipkart has launched “Flipkart Quick” a hyperlocal delivery service which delivers grocery to customers in 90 mins. Not to be left behind Amazon is putting more focus into its ‘Amazon Pantry’ and ‘Amazon Fresh’ offerings and Swiggy, one of the leading food delivery platforms launched a trial run of its quick grocery delivery service in Gurugram called ‘Swiggy Instamart.’ In fact even as the lockdown was in progress, both BigBasket and Grofers were in the news for announcing plans to hire 10,000 and 4,500 workers respectively.

The entire OTT industry is going great guns. In fact many of them have launched new plans aimed at select audience niches, based on language, data usage and number of devices. Clearly, more time at home has translated into more time on entertainment. Another factor for the growth of OTT has been the availability of low cost data driven by companies like Jio and the bundled offerings of content that the company provides to customers as value adds.

Online gaming is also booming, as millennials are using stay at home as an opportunity for honing their gaming instincts. Responding to this, gaming companies are launching newer products to keep responding to the rapidly growing market. The stay at home has prompted young and old alike to get addicted to these games and the PUBG ban came as a disappointment to young and old alike. It remains to be seen if there is any solace in FAU G – pun intended. News reports say that the industry is expected to grow at the rate of 47% by FY 2022. By 2024 it is expected that the Indian gaming industry will be valued at $3,750 million.

It is no surprise that many of these sectors are dominated by Indian companies. This certainly ties in well with the government’s Aatmnirbhar campaign and also bodes well for the revival of the economy.

Other Posts

11a116e6af9a77eff1002f28bf87b19b

11a116e6af9a77eff1002f28bf87b19b

11a116e6af9a77eff1002f28bf87b19b

11a116e6af9a77eff1002f28bf87b19b

The real winner is one who creates champion of champions

Blogs at Consocia

The real winner is one who creates champion of champions

We celebrated Teachers day recently, and when I was wondering who could one of the best teachers who could inspire a nation, one name which struck me – my friend Pulela Gopichand. My association with Gopi started fourteen years ago, when he was starting a badminton academy in Hyderabad. The purpose was clear. A champion who wanted to dedicate himself in building more champions for the future. Our association continued to grow and I still remember in 2016, PV Sidhu won the silver medal for badminton and Gopi was the coach. I spoke to him at length on this amazing feat as he was her coach. The flow of emotions generated by PV Sidhu’s pulsating match where she defeated the then world champion was spontaneous and overwhelming. I wanted to live the moment of victory and my spontaneity of connecting with him and by celebrating that moment together.

During pandemic, we started Consocia Conversations every week, and we invited for our associates and clients every week and we invited Gopi recently. My team peppered him with questions, and as earlier, and all of us were struck by his courage, tenacity, simplicity and humility as shared the secrets of his achievements. As the team listened with rapt attention to his anecdotes and the stories of how he created victory after victory from even the most difficult of situations, it struck me how these learnings are equally applicable in business situations.

Gopi touched upon several times on the importance of courage, and having a strong unwavering faith in ones abilities. Over the years, I have often counselled top corporate executives about sticking to the values of the company, no matter how difficult a situation we were facing. Having trust in your own abilities, and having self-confidence can make a person a winner even if he or she is entering uncharted territory. I re learnt this when I started my own business and was pitching to clients on subjects which I was touching for the first time. Though my company had just been launched, but there was supreme confidence and courage that I and my co-founder Praveen Aggarwal started off with. We exerted ourselves and formed a long term business relationship with our first client. When sportspersons have faith in self, they win matches, when entrepreneurs have faith in self, they win clients and create victories for the clients.

Every now and then I get goosebumps when some of my ex direct reports tag me in social posts to thank me for helping enable them achieve success. Champions like Gopi helped me revisit my purpose of nurturing and growing people in the field of branding, communications, advocacy, engagement with stakeholders and new media.

One of the tenets that Gopi discussed, was his approach towards creating success for self and others. He spoke on how it was important to shift the mindset towards fostering an environment that makes all team members winners. At Consocia, there have been several occasions where clients have faced business crisis. Irrespective of the client servicing team, I have motivated and guided all Consocians to come forward and work as one. With combined efforts, we have produced excellent results and created outstanding work which has resulted in accolades from clients.

With passion, courage and selfless dedication, Gopi has changed the status of badminton in India and his coaching has brought honour to the country several times. His academy has produced multiple champion players including Saina Nehwal, P. V. Sindhu, Sai Praneeth, Parupalli Kashyap, Srikanth Kidambi, Arundhati Pantawane, Gurusai Datt and Arun Vishnu. He guided Saina Nehwal to win the bronze medal at the 2012 Summer Olympics and P. V. Sindhu for the silver medal at the 2016 Summer Olympics. Businesses and communicators who follow these sterling qualities will triumph in every arena like this champion will create more champions.

Other Posts

11a116e6af9a77eff1002f28bf87b19b

11a116e6af9a77eff1002f28bf87b19b

11a116e6af9a77eff1002f28bf87b19b

11a116e6af9a77eff1002f28bf87b19b

The real winner is one who creates champion of champions

Blogs at Consocia

The new responsibility code of brands

The old advertising adage goes, “All publicity, is good publicity.” I have seen many communication professionals take this as a gospel truth. However, companies which are sensitive to customers’ needs and perceptions always watchful of the holy trinity of correct communications, namely “Culture, customers and creativity.” Let’s take a closer look at the name change case of “Fair and Lovely”. Almost three decades ago, when I was at the Lever’s group, we faced pushbacks for the “Fair and lovely” brand even then. However, popular customer sentiment in India was hugely in favour of the brand. It was popular knowledge that several leading Indian film actors and actresses of the day were regular users of the product. The cultural and societal dynamics of the day allowed advertisements for such products, and this thought process exists in India even today. One regularly sees matrimonial advertisements seeking “fair” brides or grooms. Skin complexion bias is a known and tolerated cultural norm, and the communication of the brands reflected this since many decades.

Cut to 2020, and there is a global uprising sweeping the globe on issues related to racism. The anti-racism protests and activism that were sparked from the death of George Floyd in Minneapolis has reignited several debates, and many of these discussions are centered around marketing and imagery that is used to sell products. In this supercharged atmosphere, it comes as no surprise that brands are picking up the cues of the changing feelings and perceptions of customers.

This is perhaps the context to understand Hindustan Unilever Ltd. decision to re-name an entire best-selling range of ‘Fair & Lovely’ products as ‘Glow & Lovely’. Additionally, the company has also decided to remove nomenclature that propagates racial stereotypes. While the name might have been socially acceptable in a bygone era, it is clearly not so now, and the company has quite correctly take the stance to change all names that might not be acceptable for the worldview of consumers of today.

The other aspect of responsibility by brands is correct product information so that there are no misleading claims. The huge furore over the launch of Patanjali brand “Coronil” was due to the fact that the company had first given the impression that the product was a “cure” for COVID. Government agencies immediately questioned Patanjali’s claim to have developed a drug to cure COVID-19. Under pressure from regulatory authorities the brand changed the positioning of the product to that of an “immunity booster”. The above case is not an isolated one. According to news reports the Advertising Standards Council of India (ASCI) has flagged off 90 advertisements since April for violating the AYUSH Ministry guidelines and making claims related to Covid-19 across media platforms in May. This proves that there is an urgent need for business self-regulation as well as regulatory oversight.

Other advertisement campaigns which faced flack in the media were of cricket hero M S Dhoni, in a campaign for Matrimony.com campaign for claims could not be adequately substantiated, and there was also a mention of the fact that Dhoni appeared to not have done any due diligence prior to endorsement. Telecom major Vodafone Idea also faced some heat for its ‘REDX’ campaign for misleading information in their advertisements and lack of appropriate disclaimers.

On a positive note, there are also several instances of responsible behavior as well. MAI (the Multiplex Association of India) and the major cinema brands Inox, PVR and Cinepolis have all taken steps to create a set of safety SOP’s that can be benchmarked with the best in the world. They have factored in safety aspects for customers and employees. This is a significant initiative which can provide a global standard safety net for customers. In the conditions of the day, this behavior is not only responsible but also admirable.

So, summing up the maxims of articulated above, we see that the quintessential struggle for brands is essentially their effort to create a positive narrative about the brand while conforming to the prevailing cultural and ethical sensitivities of the day. I and my team at Consocia Advisory, are working with various associations, which are trying to rebuild positive brand narratives and work proactively with the government to build lockdown exit strategies for better functioning. A key tip we always share with clients is to keep in mind the socio cultural sensitivities and challenges while trying to frame the communication plans for any brand.

Other Posts

11a116e6af9a77eff1002f28bf87b19b

11a116e6af9a77eff1002f28bf87b19b

11a116e6af9a77eff1002f28bf87b19b

11a116e6af9a77eff1002f28bf87b19b

The real winner is one who creates champion of champions

The Retail Sector: Navigating the Pandemic Crisis Headwinds Towards Recovery & Sustenance

The Retail Sector: Navigating the Pandemic Crisis Headwinds Towards Recovery & Sustenance

Considering what the world has learnt from previous recessions, the key aspects to stress on during this pandemic crisis are that they expose existing weaknesses, accelerate emerging trends and force organizations to make structural changes faster than they had planned. This is particularly true in retail. During the recession of 2008–2009, e-commerce grew and brick-and-mortar retail declined. As the economic recovery took hold, that trend continued while off- price, discount and emerging players succeeded by appealing to new consumer demands.

In the wake of the pandemic crisis, a similar pattern is being followed, albeit with new trends shaped by a pandemic-driven global recession. Evidently, certain truths remain: Retailers struggling before COVID-19 will likely see their declines accelerate. Income disparities will drive continuing business toward off-brand and discount retailers and online shopping will continue to accelerate.

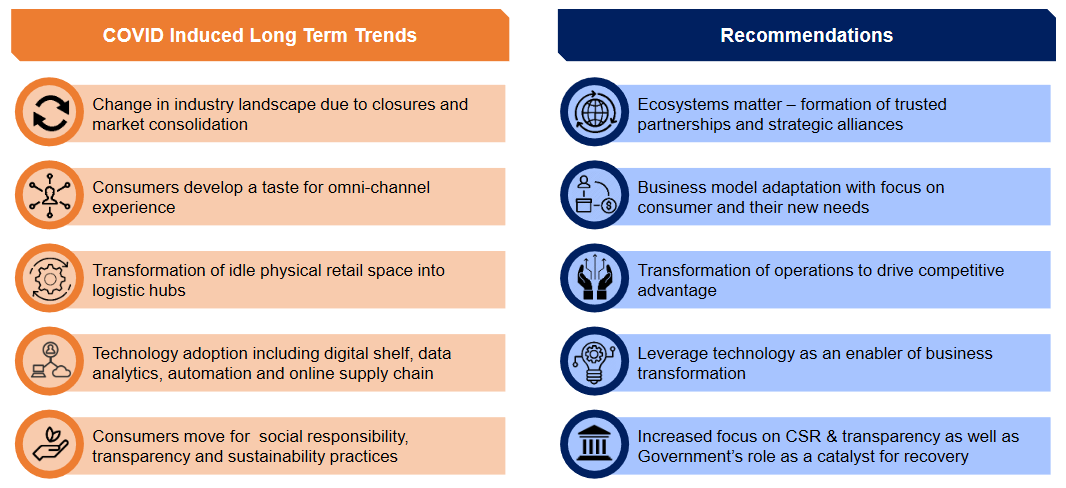

But several other potential trends are shaping the COVID-19 era retail environment. These include the following:

- Product mix will likely change and retailers will need to forge new partnerships to thrive

- Consumer-retailer interactions will be defined by health and safety expectations

- Demands for convenience will drive even more contactless transactions

- Retailers will depend meaningfully on the trust they have with consumers and other stakeholders

COVID-19 is having a significant impact on product demand and sales channel preferences through denaturing consumer behaviour. Consumers spend more time at home, are faced with deflated social lives and restricted mobility, heightened health concerns and financial insecurity.

The observations that provide clarity to the prevalent situation are that retail orthodoxies will be challenged and the industry will likely look much different than when the world entered this crisis.

- Direct interaction with shoppers, once the foundation of customer service, has been replaced by virtual or contactless touchpoints

- Returns processing might increase amid more online sales that will require new safety standards to meet customer expectations

- Stores have turned into mini-fulfillment centers and pickup points

- Supply chains are being restructured to fulfill specific orders to households rather than to large-format stores

For now, the picture may appear bleak. But retailers who grasp the challenge and join the gathering trends could well emerge stronger and provide a brighter future for employees, customers and stakeholders alike.

What this presses for is a structural change in the industry. By challenging traditional orthodoxies, retailers can redefine the basic assumptions by understanding how to build trust with stakeholders, how to operate stores in new ways and how to structure their entire operations around new consumer expectations. With major trends accelerating, retailers have an opportunity to create a resilient architecture and a mandate to thrive in a new way.

Issues faced by the sector due to COVID-19

Within the technology and software industry, the issues that could be faced due to COVID-19 are in the following key areas:

- Healthy, safe and local: One of the biggest challenges facing retailers is the need to protect customers and employees from contracting or spreading COVID-19. Increasing focus on improving health, paired with increased demand for fresh food could drive longer-term habits focused on healthy lifestyle and nutrition

- Shift to value for money: As in any economic downturn, a post- crisis downturn will probably lead consumers to demand value for money across retail sectors. This is already happening in essential categories, as private-label sales at grocers and pharmacies are increasing and pricing and promotion strategies are emphasizing value

- Flexibility of labour: This crisis underscores the need for more flexible resource allocation that deploys labour across a broader range of activities. This could accelerate the move toward more agile and dynamic resourcing from stores to distribution centers to corporate offices

- Loyalty shock: Scarcity of products has spurred trial of new brands, as customers trade up and down. In Asia and the United States, but less so in Europe, store and brand switching due to proximity, availability, ease of use, and safety considerations, creating opportunities for new habit creation is observed

- Managing demand fluctuations: While some retailers are seeing demand fall away and customers shift channels, others are facing unprecedented spikes in demand. Grocery retailers are dealing with out-of-stock situations on many key products as consumers hoover up supplies perceived to be essential. The ability to predict and manage demand has never been more important

- Protecting the people: The COVID-19 virus has already led to a number of workplace shut-downs and quarantines. Retailers must have a plan that ensures the safety of employees while also trying to maintain business as usual activities. Beyond simply creating a crisis communications plan, retailers should be thinking about managing their workforce under various different scenarios

- Evaluating long-term supply challenges: Non-food retailers are not yet feeling the full impact of supply disruptions due to drops in demand coupled with long lead-times and inventory warehousing. But as the situation evolves, significant variations in the volume and timing of supply chain disruptions across geographies and subsectors are anticipated

- Shoring up cash reserves: Retailers with physical footprints are rethinking their current cash positions. Given the industry's high dependency on cash to pay for stock, real estate and staff, many retailers are now, through trade body representations, talking with policy makers to see how they can influence and take advantage of any hardship funds, rental renegotiations and rate holidays

Evolving Industry Trends and Recommendations for Business Recovery & Proliferation

Retail sector Impact and Policy Responses

COVID-19 has dramatically disrupted the retail sector, with the shock differing massively between brick-and-mortar versus online shops, essential versus non-essential stores and small versus large retailers. The mitigation measures aimed at slowing the novel coronavirus (COVID-19) pandemic taken over the past few months have directly affected the supply, demand and daily operations of the retail sector. It mainly serves final demand and thus occupies an important position in value chains both as a provider to households and as an outlet for upstream sectors. It also often complements activities in other hard-hit sectors, e.g. tourism. In addition, the retail sector is very labour intensive, so any disruptions have disproportionate employment consequences.

The sector also relies on low-wage and part-time, on-call and gig workers that are not well-covered by traditional social protection measures, which further strengthens the social consequences of the crisis in this sector. At the same time, the impact of the COVID-19 crisis on the retail sector is heterogeneous and depends on the combined effect of three characteristics. First, the effect of social distancing measures on individual retail businesses depends on whether they are deemed essential. On the one hand, most non- essential retail activities have been shut down; essential retail businesses, on the other hand, often operate in difficult conditions, with labour supply shortages, major disruptions in supply chains and working conditions, and large spikes in demand for specific items.

Second, lockdowns and social distancing measures affect retailers with physical stores more than online retailers, and may ultimately accelerate the ongoing shift from brick-and-mortar to online retailing. Third, the sector is characterised by the coexistence of businesses with strikingly different abilities to weather the crisis, linked to different liquidity positions and access to outside finance.

Five policy response measures that countries need to take now for the benefit of firms, workers and customers to shield the retail sector from the effects of the crisis and enhance its resilience are as follows:

- Ensure that liquidity assistance schemes are accessible to retail firms, irrespective of their size

- Help essential retailers deal with labour supply shortages, in particular by smoothing demand-supply matching for retail jobs and providing guidance on health and safety standards

- Support retail firms to implement social distancing measures

- Ensure that competition in the sector remains sufficient in the aftermath of the crisis

- Increase retail firms’ resilience by diversifying their sales channels, in particular by helping small brick-and-mortar retailers go online

In these exceptional crisis circumstances, there are instances where co-operation between competitors is legitimate and lawful in order to overcome disruptions, especially in essential retail supply chains.

Against this backdrop, governments need to ensure that competition remains sufficient to avoid negative impacts on consumers.

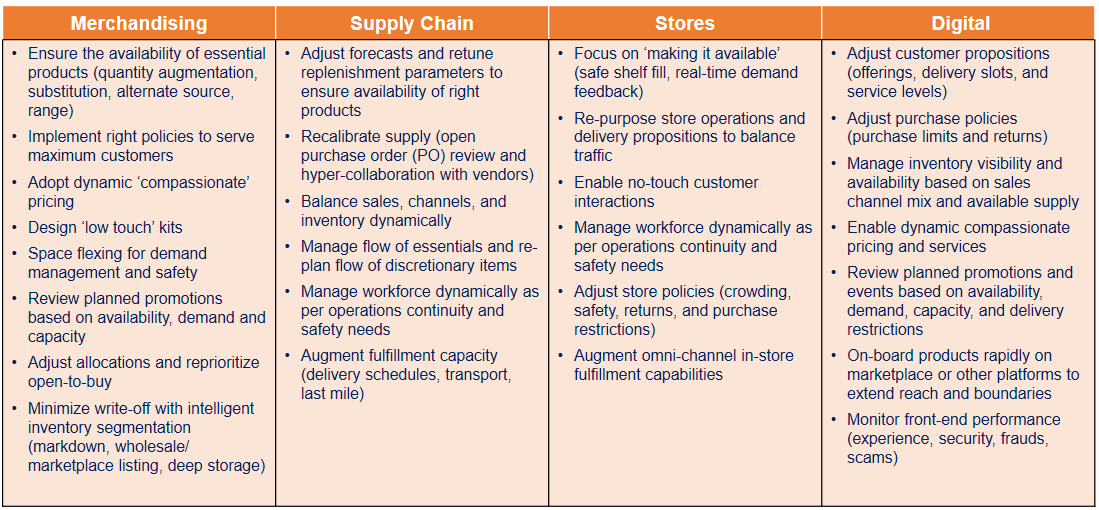

Value Chain Actions for Holistic Revival & Sustenance of the Retail Sector

Industry Outlook – The Indian Perspective

Indian retail industry has more than 15 million retailers, both small and big, traditional and modern trade. Retail industry employs 46 million people, out of which 90% are in blue collar segment. Modern trade employs more than 6 million Indians equalling to almost 12 per cent of the total Retail consumption of the country. Retail contributes to approx. 40 per cent of India’s Consumption and 10 per cent to India’s GDP. The lockdown to prevent the spread of coronavirus in the country has greatly affected retail business. With unlock 1.0 and

2.0 coming into effect, most retail stores, high streets and malls have opened up but the footfall still remains significantly low. Essential- only commodity retailers have seen a hike in demand while non- Grocery/food retailers are reporting 80 per cent to 100 per cent reduction in sales in comparison to pre-COVID sales. Even retailers of essential items are facing losses as there is a big dip in demand for non-essential items, which would bring them higher margins.

There is a shift in consumer behaviour from offline shopping to online as people who were previously averse to online buying are now being compelled to explore online due to the restrictions in force. Organizations should closely follow consumer patterns and have an adaptive business model to stay relevant. Another shift in buying behaviour, especially for millennials is that they may choose to purchase only what they really require and hence buy less than they would earlier. While big-ticket purchases will be most likely get pushed to another 3 quarters, there may be an increase in small-ticket spending like eating out, buying apparel for feel-good post lockdown. This will be more like symbolic buying.

Though there is a significant impact on the retail businesses, recovery will depend on the nature of the sector. Leadership will focus on cost efficiency than growth. Focus will be high on efficiency and achieving more with less. This means some functions may see consolidation, pilots will be put on hold and focus will be more on fundamentals. Discretionary spending like entertainment, travel, admin costs are more likely to be cut than people costs.

Organizations which are already highly leveraged are going to face the toughest challenges to get back on feet. Collaboration will be the key in recovery. Collaboration in areas such as compliance within stores, collaboration for revenues, for distribution & delivery and collaboration for costs.

Recovery will be dependent on the Government’s support to the sector. Retail industry is estimated to take 9-12 months to recover amid the pandemic. The demand for non-essential retail is projected to open with 40% of the value noted in pre-Covid times. The cost of business across non-essential sectors is likely to increase by 30- 35% post lockdown. In the absence of major support, as many as 20-25 per cent of retailers may be out of business or will need dire financial infusion to stay afloat. Government should focus on giving more money in the hands of the consumer, which will automatically come back in the system as consumer spends increases. Stimulus from the government can be a big push.

Reputation Challenges for the Industry

As various parts of the country proceed through a phased reopening, retailers are challenged with opening their stores in a safe and efficient manner. As pressured as they may be to reopen quickly, taking the time to understand consumers’ state of mind as they venture back out into the world will help retailers identify ways to ease consumer anxiety; maximize shopper confidence; and stand out from competitors as a safe, reliable and caring partner.

Taking the “we’re all in this together” approach could be considered harder, as it requires more thought, more cross-departmental coordination and may cost more in the long run. But it also comes with clear short-term benefits, not to mention many long-term benefits as well, including building customer loyalty and developing a reputation for a safe and friendly place to shop.

It’s also important to consider the very real possibility that many of these seemingly temporary changes to the in-store experience will become lasting changes. In this regard, the COVID pandemic may be an opportunity for the savvy retailer to distinguish itself from competitors. Indeed, a safe and trusting in-store experience with help from friendly in-store associates is an experience that online platforms cannot replicate. The Global Web Index survey shows that 56 percent of consumers surveyed say brands that can best meet their needs will resonate most long term. 38 percent further said that those companies that can demonstrate that they helped people during the pandemic will be considered most long term. Old thinking cannot be brought to bear to solve new problems and despite a host of ongoing challenges, in order to grow customer loyalty, develop new customers, and grow their reputation during COVID-19, retailers must keep the anxious customer front and centre in all of their decision making as they reopen stores.

Many organisations are having their company values put to the test when it comes to their actions in balancing the support and protection of staff and customers with income and profit. A communications strategy for employees, partners, suppliers, authorities and the public is key to a risk management plan.

Imagine clear and friendly signage throughout the store that helps shoppers know where to go and what to expect. Imagine trained and calm staff, ready to help whenever needed. Imagine a checkout process that lets customers know contactless payment is an option, even providing instructions on how to quickly setup mobile payment solutions. Retailers that commit to fully implementing these changes during the reopening process stand to see long-term benefits in addition to the more urgent short-term benefits.

Consocia Advisory, has been at the forefront of building and protecting organisational and brand reputation for several sectors.

We remain available to curate effective programs to pre-empt and mitigate risks through process-thinking, process-improvement and institutionalisation of best business practices, so as to anticipate risk events, minimise their impact and safeguard the overall future of the enterprise.

Cushioning the COVID impact on our clients: Consocia’s value driven services providing dynamic solutions

As COVID-19 grew into a global crisis, Consocia realized the need to support industry colleagues in dealing with the biggest challenge faced ever in recent times that of business continuity. In response to the situation, we were swift in curating an in-house crack team comprising experts in research and insights; stakeholder database generation; content; government relations and public policy.

Consocia Advisory engaged Central and State Governments besides many Districts through strategic narrative backed by data to highlight the need of the hour in the fight against the deadly pandemic. We urged immediate orders to restore Client’s ability to manufacture, warehouse, transport and distribute the client’s essential products across the country.

Presently, Consocia is working with several enterprises for business continuity as well as crisis management. In the last few weeks, we have helped opening of plants and warehouses of the Indian entity of a global disinfectant company in 6 states including in Red zones as well as

Containment areas, besides that of a renowned lighting solutions company in two states (Haryana and Karnataka) already while they are now looking for our assistance in three more states.

Within a few days of being on-boarded, through our 24×7 support, we were able to secure not only policy interventions for manufacturing but also for warehousing, logistics and distribution as well as access to staff & workers. In the process, we were able to assure the Central and State Government stakeholders that all due precautions are being taken to prevent and contain COVID 19. We even helped with internal SOPs for transportation and staff movement.

We are helping the apex body representing the Shopping Malls across India against the debilitating impact the Coronavirus pandemic has had on them. On behalf of SCAI, Consocia has crafted several interventions to draw the attention of the stakeholders and policy-makers on the plight of the industry and reinforcing reasons for Malls to be considered for resuming operations in a staggered manner, for the post-lockdown phase. At the same time, Consocia is working with the empowered Group of Ministers and Committees for COVID-19 response as well as the RBI seeking urgent financial stimulus for the sector and amplifying the initiatives through media engagement from time to time.

The upcoming editions of the dynamics of business transformation white paper series will focus on specific industries with strategies and outcome driven solutions to positively impact business outlook for business recovery and continuity in the COVID-adjusted world.

COVID-19 is a long battle for the industry. As your trusted well-wisher, our team is available to support you during these uncertain times in the areas of business continuity planning, public affairs, public policy and government relations. Contact us: reachus@consociaadvisory.com

Recent Posts

11a116e6af9a77eff1002f28bf87b19b

11a116e6af9a77eff1002f28bf87b19b

11a116e6af9a77eff1002f28bf87b19b

11a116e6af9a77eff1002f28bf87b19b

The real winner is one who creates champion of champions

Technology & Software Industry Reinforcing Value Chain & Stabilizing Valuations for Business Resilience

Technology & Software Industry Reinforcing Value Chain & Stabilizing Valuations for Business Resilience

Due to the deeply interconnected market, the global technology, software and web application development industry felt the tremors from the pandemic crisis. Now when the whole world is captured in COVID and the major areas of developed industries are locked down, preventive health measures are a greater priority than the custom software development, which puts the industry in a fix.

While software indices experienced fluctuations due to nationwide shutdowns and stay-at-home orders, most select indices have returned to their pre-COVID levels, as the software industry is considered a structural winner given the need for greater digital capabilities across all industries. Infrastructure, Development and ERP software segments have seen significant stock and multiple expansion due to their offering of reliable cloud-based solutions that are in high demand by a growing remote workforce. Security software is expected to see increased spending as organizations secure endpoints and rectify vulnerabilities in the public cloud.

In the mid-term, it is expected that software companies with a high degree of recurring revenue, strong profit margins and critical assets around communication, collaboration, content delivery and security to experience increased demand and usage. Valuation multiples across these offerings are likely to see significant expansion. In the long term, software valuations would remain stable due to their ability to counter significant exposure to macro-sensitive events and drive cash flow by means of flexible, recurring revenue models. M&A markets are also expected to rise over the next several quarters with an increased prioritization on critical cloud infrastructure assets and other mission critical solutions, as per industry reports.

The novel coronavirus is still wreaking havoc in all the industries globally. The business and lives of people have been impacted due to the life-threatening effects of the coronavirus. The majority of IT and Tech giants across the world have committed to giving utmost priority to public health and have made significant changes in the employee working modes. Major tech conferences and events have been cancelled or turned into digital events in the wake of the crisis.

Considering the far-reaching ramifications within manufacturing, work in the corporate and technology sector has been impacted to a great extent. Many companies in the global industry landscape have either shut their factories or banned business-related traveling. Major industry events like Facebook’s F8, Google I/O, the Geneva Motor Show and the Mobile World Congress have been called off due to the outbreak. Several organizations have also encouraged their employees to work from home to prevent further outbreak of the coronavirus disease.

Most companies already have business continuity plans, but those may not fully address the dynamic and unpredictable variables of an outbreak like COVID-19. Typical contingency plans are intended to ensure operational effectiveness following events like natural disasters, cyber incidents and power outages, among others. They don’t generally take into account the widespread quarantines, extended school closures and added travel restrictions that may occur in the case of a global health emergency.

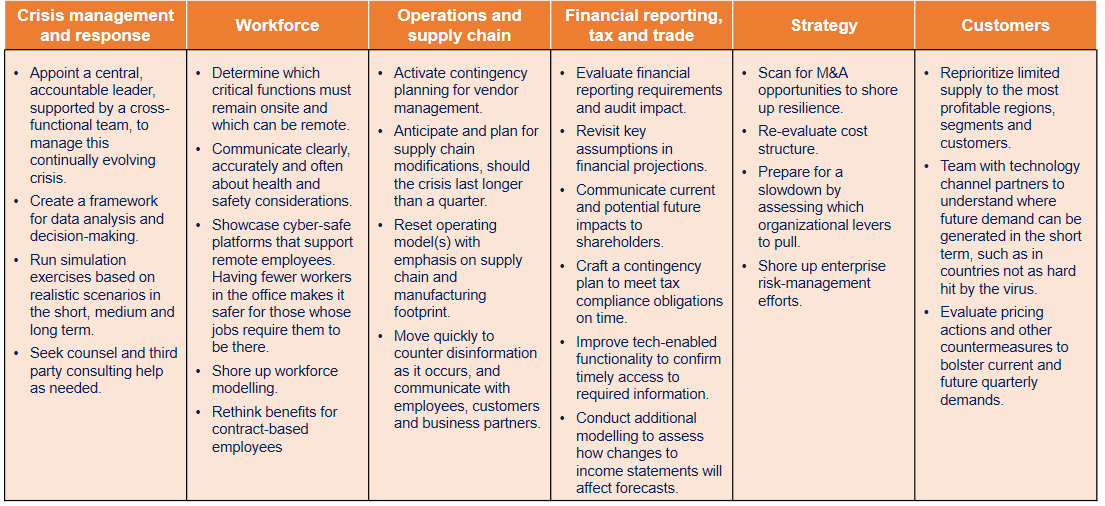

Issues faced by the Industry due to COVID-19

Within the technology and software industry, the issues that could be faced due to COVID-19 are in the following key areas:

- Crisis management and response: Due to the dynamic scenario, business continuity planning does not account for the uncertainty of an evolving pandemic. Also, industry event cancellations mean fewer business development opportunities. Diminished business travel results in fewer client interactions.

- Workforce: Staffing concerns have increased for full-time employees, as well as contract workers, such as drivers, delivery workers and retail staff. A slowdown in recruiting resulting from the crisis could affect a future pipeline of skilled workers. Cybersecurity risks are likely to rise as a result of more people working remotely.

- Operations and supply chain: Global supply chain disruption would lead to production slowdown. Cash-flow challenges will test undercapitalized companies and may require alternative sourcing and the need to subsidize during the crisis to confirm readiness in its aftermath. As companies seek business solutions to address remote work, social distancing and the need for in-store alternatives, the demand for developer and engineering talent is likely to increase. Retaining top talent will be essential. Disinformation proliferates on digital platforms which would cause reputational issues for media technology platforms and communication services which would need strict intervention. Sharing economy inventory would take a hit during this period. Some component manufacturers rely on one or perhaps two main suppliers. Additional containment zones around the world trigger more shipping and delivery bottlenecks.

- Financial reporting, tax and trade: Operational, workforce and supply chain disruptions will trigger financial reporting implications in current and future reporting periods. Public companies will face increasing pressure to disclose revised guidance related to the COVID-19 impact. New state and local tax implications arise for workers who are now remote as a result of the crisis. Tax compliance operations could lag, as newly remote employees lack timely access to information.

- Strategy: Sudden or prolonged economic downturn will lead to companies considering significant budget cuts that eliminate discretionary spending. The crisis underscores the need for flexible, resilient business models, including increased focus on cash-flow forecasting and impacts on supply-chain and commercial-channel partners. Company valuations may become more attractive for acquisitions by cash-rich companies that have been sitting on the side-lines, while keeping targets in mind.

- Customers: Tech sector companies rely on overseas consumption, which has slowed since the outbreak. Customers are delaying purchases because the pandemic has exacerbated an already uncertain global economy. Technology support may struggle to keep up with customer needs on applications.

Steps to counter existent issues for business resilience and continuity

Potential Impact on Technology sub-sectors

- Hardware/software: In contrast to the parts shortage and unpredictability of supply chains concerning the hardware industry, software is a growth catalyst. Companies with remote-working technologies are already seeing increased demand as businesses increase their remote-working capabilities. Security software will see third-order benefits from a growing remote workforce. IT spending on security software will increase as organizations race to secure endpoints, particularly cloud-based tools, log management, and VPNs. Hardware companies may see major demand coming from enterprises, who are placing large orders for laptops and mobility devices to support employees now working from home.

- IT services: IT spending forecasts indicate continued demand for cloud infrastructure services and potential increases in spending on specialized software. Forecasts also anticipate increased demand for communications equipment and telecom services as organizations encourage employees to work from home, and schools move to online courses. Most organizations do not have a tech stack in place for a reliable business-continuity plan (BCP). Due to enhanced remote work scenarios, IT departments will play a larger role in future BCPs, and will need help from IT service providers in procuring devices, setting up a resilient, flexible and secure network, disaster recovery systems, IT security, etc. The need for faster access to data and automation will enhance the focus on network equipment and communications like never before, speeding up 5G network deployments and adoption of 5G equipment.

- Semiconductors: Raw-material supplies such as aluminium, copper and chemicals are affected by disruption, with delay in delivery by up to a quarter and will be difficult to re-inventory. Near-term actions are resulting in supply and fulfilment disruptions up and down the electronic manufacturing value chain. This may result in a shortage of components, creating choke points at circuit board and systems manufacturing. In the longer term, new product schedules might get delayed and product go-to-market strategies may need to be changed to meet the velocity of the value chain. Delays could result in reduced participation in customer meetings, internal meetings, and external events. In the long term, companies could be required to address the risks of geographical concentration and lack of resiliency to avoid single points of failure and limit future disruption.

- Network equipment: Increase in the use of teleconferencing software as more technology companies encourage employees to telecommute will have potential benefits for companies that have technologies already deployed in that space. Need for ever-faster access to data and automation will enhance the focus on network equipment and communications as never before, speeding up 5G network deployments and adoption of 5G equipment.

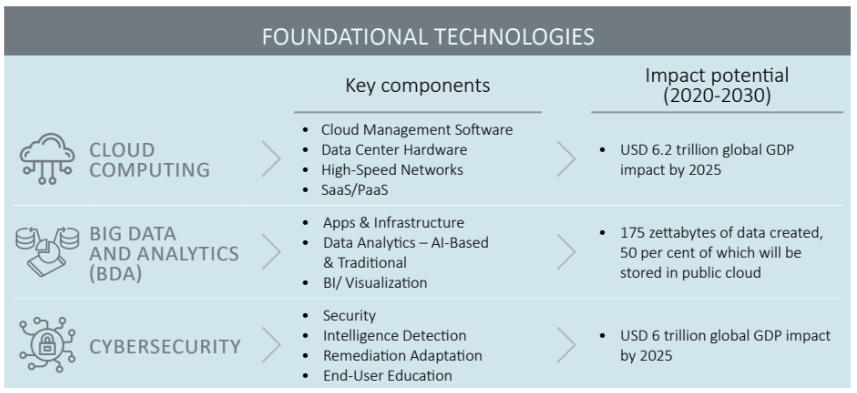

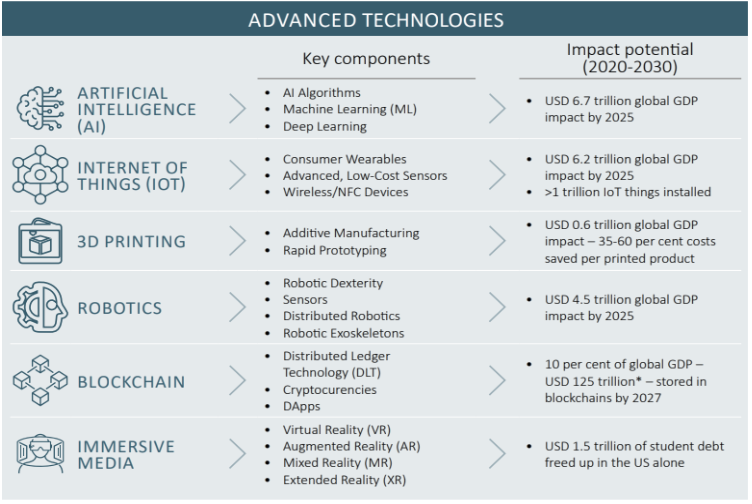

Technologies with high strategic impact potential in this decade (1/2)

Technologies with high strategic impact potential in this decade (2/2)

How Tech & ITES could revive other impacted sectors

COVID-19 has been called a once-in-a-century event. In its wake, we are likely to see a lasting shift in employee expectations, a greater capacity to respond to sudden, global disruptions, an accelerated adoption of artificial intelligence and automation, and more automated and diverse supply chains. High tech companies that invest now in creating an Elastic Digital Workforce will be much more prepared for a post-COVID-19 world.

Technology and software solution providers could help revive severely impacted industries during this crisis by supporting in scaling and adapting to the transforming business needs. Solution providers could partner with organizational leaders, in collaboration with their respective internal IT teams, to ensure that all employees have access to, as well as the ability or proper training to use remote working tools. They could push for universal adoption and model their use. Business continuity plans should account for the Elastic capacity of a digitally enabled workforce, as well as potential reductions in workforce and travel. Powered by a strong culture, organizations can set about strengthening or replacing every aspect of their technology that could support an Elastic Digital Workforce, such as distributing the right equipment to employees. Networks that connect devices to homes where workers and customers reside must be shored up, and security protections for data flowing over those networks must be assured. Acting quickly helps to weaken the impact of COVID-19 on businesses. In fact, the positive effects of a transformation to an Elastic Digital Workforce can be felt quickly with the help of effective partnerships with the technology enablers and software solution providers.

With more people working from home, a new challenge arises in the form of cybersecurity breaches and malware attacks. Cybercriminals disguised as alarming COVID-19 news reports have also been reported, targeting the global workforce with phishing emails containing malicious software. Technology sector partners could help to reassess their security threats and ensure that their client company’s firewall, antivirus protection and other security features that demand authentication are in place to mitigate malware risks.

Also, technologies such as cloud telephony and cloud-based document sharing have made communication between teams seamless and flexible. The right tools and methodologies can help businesses keep their operations seamless. Productivity need not happen only in a brick-and-mortar office.

The technology sector has already come out in strong support to work with medical practitioners and governments to contain the Coronavirus. Several start-ups too, have deployed drones and AI- based robots for high-risk tasks, such as patrolling public places, disinfecting rooms and communicating with infected patients.

Technology will continue to thrive by lending technological support during a large-scale health crisis such as COVID-19. However, innovation will be the true game-changer.

With more people working from home, a new challenge arises in the form of cybersecurity breaches and malware attacks. Cybercriminals disguised as alarming COVID-19 news reports have also been reported, targeting the global workforce with phishing emails containing malicious software. Technology sector partners could help to reassess their security threats and ensure that their client company’s firewall, antivirus protection and other security features that demand authentication are in place to mitigate malware risks.

Also, technologies such as cloud telephony and cloud-based document sharing have made communication between teams seamless and flexible. The right tools and methodologies can help businesses keep their operations seamless. Productivity need not happen only in a brick-and-mortar office.

The technology sector has already come out in strong support to work with medical practitioners and governments to contain the Coronavirus. Several start-ups too, have deployed drones and AI- based robots for high-risk tasks, such as patrolling public places, disinfecting rooms and communicating with infected patients.

Technology will continue to thrive by lending technological support during a large-scale health crisis such as COVID-19. However, innovation will be the true game-changer.

Industry Outlook – The Indian Perspective

According to the International Data Corporation (IDC), growth in global Information Technology spending is expected to reduce by 3- 4% by the end of 2020, considering the conservative scenario due to the outbreak of Coronavirus disease (COVID-19) pandemic.

However, adoption of collaborative applications, security solutions, Big Data and AI are set to see an increase in the coming days.

Observing the scenario of Indian market, a slowdown in terms of discretionary IT spending, contract renewals and new deals getting signed as enterprises recalibrate by cost structure is expected in the short term. Existing project executions have also taken a hit due to travel restrictions in place. Companies will be forced to relook at their growth targets for the rest of the year as the impact will become evident in the next few quarters. On the other hand, it has provided an opportunity to organizations to test their resilience on business continuity, remote connectivity, and security as they look at innovative ways to service their clients. Enterprises are looking at IT vendors to handhold them in the hour of crisis.

With corporates across the country implementing alternative ways of working, it is generating a parallel corporate line that demands to be connected from where they want, when they want and to who they want. While work from home is not a new concept for Indian corporates, it certainly is a testing time to see the success at this scale. Enterprises are also exploring ways of working together that leverages conversations, meetings, and assets across platforms with employees working remotely from wherever they are located to serve customers better and ensure business continuity. The adoption of collaborative applications growing at a rapid pace after the COVID-19 outbreak is evident in the current scheme of things.

As organizations are taking preventive measures to curb the spread by encouraging their workforce to connect from home, there are different sets of challenges that the IT teams within the organization are grappling with – how to secure data and assets from cyber threats. The adoption of a zero-trust policy is expected to increase, in the months ahead, as an increasing number of people connect to work from personal networks. organizations would tend to keep their VPNs and Firewalls updated with security patches in place.

IT vendors should focus on building/improving capabilities on AI and Big Data as new challenges and use cases emerge.

While the economic impact of the COVID-19 outbreak is evident, it has provided an opportunity for Technology & software solution vendors to become more resilient and innovative. Solution vendors should look at offering incentives on the existing contract extensions and also build conversations on business continuity and disaster recovery in the cloud. Technology players should also keep an eye on emerging uses cases in AI for disease detection, tracking, and prevention. While challenging times await hardware manufacturers, it opens an opportunity for IT vendors to handhold the clients in the hour of crisis as a trusted partner and help them sail through the situation.

Reputation Challenges for the Industry

The Covid 19 pandemic has changed the way customers behave and is forcing businesses to rethink their strategy. Technology and software companies have numerous challenges to take care of; from reviving the business to ensuring that they have runway for the next 9-12 months in case the growth of the economy is slow.

Covid 19 has accelerated a lot of the key technology, business, professional and work / life related trends that have emerged. At the same time, it has exacerbated risks and threats that companies face from cyber compromises. The reputational risk profile of each business is different depending on variables including sector, size of business and varying degree of internal and external threats including the extent to which, the reliance on technology plays a role in the business.

Most cyber security or risk & crisis management plans are not formulated with the prospect that all staff would be working from home and that an incident could come at a time when the infrastructure of an IT system was overloaded and vulnerable. Many organisations have been forced to effect changes at great speed, adopting a roll out programme that otherwise might have taken months if not years to achieve, with the inevitable risk that security is compromised and there are gaps in its systems which play to third party threats. At the same time, external threats such as phishing and social engineering are on the increase as fraudsters seek to take advantage of any vulnerability in a remote working system and preying on individuals’ personal vulnerabilities.

When responding to the challenges posed by COVID-19, technology companies must be mindful that, what they do now will impact how they are viewed in the future. With supply chains under huge stress at the moment, particularly where imported products are concerned, many businesses are struggling to comply with their obligations and either supply customers or honour contractual obligations made pre- lockdown. Where this impacts consumers, disagreements can quickly escalate to a situation where customers become frustrated with the business’s inability to supply which in turn can lead to cancelled orders and negative online reviews or comments on social media, garnering unwanted publicity and influencing other consumers away from a brand towards its competitors.

Many organisations are having their company values put to the test when it comes to their actions in balancing the support and protection of staff and customers with income and profit. A communications strategy for employees, partners, suppliers, authorities and the public is key to a risk management plan.

Consocia Advisory, has been at the forefront of building and protecting organisational and brand reputation for several sectors.

We remain available to curate effective programs to pre-empt and mitigate risks through process-thinking, process-improvement and institutionalisation of best business practices, so as to anticipate risk events, minimise their impact and safeguard the overall future of the enterprise.

Cushioning the COVID impact on our clients: Consocia’s value driven services providing dynamic solutions

As COVID-19 grew into a global crisis, Consocia realized the need to support industry colleagues in dealing with the biggest challenge faced ever in recent times that of business continuity. In response to the situation, we were swift in curating an in-house crack team comprising experts in research and insights; stakeholder database generation; content; government relations and public policy.

Consocia Advisory engaged Central and State Governments besides many Districts through strategic narrative backed by data to highlight the need of the hour in the fight against the deadly pandemic. We urged immediate orders to restore Client’s ability to manufacture, warehouse, transport and distribute the client’s essential products across the country.

Presently, Consocia is working with several enterprises for business continuity as well as crisis management. In the last few weeks, we have helped opening of plants and warehouses of the Indian entity of a global disinfectant company in 6 states including in Red zones as well as

Containment areas, besides that of a renowned lighting solutions company in two states (Haryana and Karnataka) already while they are now looking for our assistance in three more states.

Within a few days of being on-boarded, through our 24×7 support, we were able to secure not only policy interventions for manufacturing but also for warehousing, logistics and distribution as well as access to staff & workers. In the process, we were able to assure the Central and State Government stakeholders that all due precautions are being taken to prevent and contain COVID 19. We even helped with internal SOPs for transportation and staff movement.

We are helping the apex body representing the Shopping Malls across India against the debilitating impact the Coronavirus pandemic has had on them. On behalf of SCAI, Consocia has crafted several interventions to draw the attention of the stakeholders and policy-makers on the plight of the industry and reinforcing reasons for Malls to be considered for resuming operations in a staggered manner, for the post-lockdown phase. At the same time, Consocia is working with the empowered Group of Ministers and Committees for COVID-19 response as well as the RBI seeking urgent financial stimulus for the sector and amplifying the initiatives through media engagement from time to time.

The upcoming editions of the dynamics of business transformation white paper series will focus on specific industries with strategies and outcome driven solutions to positively impact business outlook for business recovery and continuity in the COVID-adjusted world.

COVID-19 is a long battle for the industry. As your trusted well-wisher, our team is available to support you during these uncertain times in the areas of business continuity planning, public affairs, public policy and government relations. Contact us: reachus@consociaadvisory.com

Recent Posts

11a116e6af9a77eff1002f28bf87b19b

11a116e6af9a77eff1002f28bf87b19b

11a116e6af9a77eff1002f28bf87b19b

11a116e6af9a77eff1002f28bf87b19b

The real winner is one who creates champion of champions

Banking & Financial Services Industry Reviving Economic Confidence through Policy Relief & Operational Transformation

Banking & Financial Services Industry Reviving Economic Confidence through Policy Relief & Operational Transformation

Once the World Health Organization declared the outbreak of the COVID-19 pandemic, uncertainty and instability among financial service entities became evident. The global financial system is slowly evolving from an initial period of extreme stress, primarily due to government level efforts to stimulate the economy, central banks’ steps towards addressing market disruptions and the resilience of financial institutions. While the initial struggle due to the financial crisis may have eased, firms and policy-makers remain concerned about a range of risks that could prove to be a threat to financial stability and economic recovery.

All stakeholders have consistently highlighted the degree of uncertainty prevalent across financial markets and institutions. There is concern about how badly the virus will affect different countries, duration of containment measures in different markets, how effective policy will be at mitigating lost activity, and how households and firms will change their behaviour in the medium term.

While financial system resilience, fiscal support, regulatory flexibility and liquidity provision to date have helped ensure that the financial system is supportive of economic recovery, a more intensive slowdown may present new risks to the financial system. Thus, while the initial phase of the crisis has eased, participants are keenly aware that there may be greater turmoil affecting the financial system as the economic fallout continues, potentially precipitating a financial crisis down the line. The economic slowdown due to COVID-19 will impact demand for loans which could dent profits for NBFCs among the other financial Service institutions. One view of a global scenario would involve a severe protracted recession in advanced economies leading to a credit crunch, as banks face greater credit losses than their balance sheets can withstand, despite ongoing central bank support which, in turn, would deepen the recession. While this scenario is not seen as likely, equity market investors should be more cognizant of downside risks.

The economic and financial crisis in emerging markets and developing economies could be worse than in advanced economies. Both private-sector participants and policymakers remain concerned about the range of risks presented by weaknesses in many emerging markets and developing countries.

While some emerging markets are better positioned to withstand and address these shocks, many are seeking various forms of liquidity support from advanced economies. There has been record demand for emergency programmes from the International Monetary Fund (IMF) and multilateral development banks, which these institutions have met by expanding the size and structure of the support offered.

Despite the challenging situation, this is also an opportunity for financial institutions to show that they understand their customers’ plight and are committed to supporting them through the crisis. The upside of these difficult circumstances is that they can be used to build stronger, enduring, trust-based relationships with customers.

Short-term liquidity is critical in ensuring confidence in the market forces at play in servicing finance, capital and debt as businesses start adjusting to the rapidly evolving operating environment.

Impact of COVID-19 on the Industry

Within Banking and Financial service sector companies, the short- term impacts in four key areas are:

- Credit Management: Non-Performing Liabilities (NPL) will surge as consumers and businesses are unable to make loan payments and there will be increased demand for new credit. If effective action is not taken, there will be a rapid rise in consumer and commercial NPLs as borrowers struggle to make scheduled interest and principal payments. There will also be a material impact on the auto and equipment finance sectors as borrowers struggle to make lease payments.

- Revenue Compression: Rate cuts as well as a collapse in demand will have a top-line impact. Emergency interest rate cuts to stimulate the economy may lead to net new lending, but will also compress banks’ net interest margin in many markets. Stock market volatility may create a flight to safety to insured deposit accounts, but the pricing on these deposits needs to be addressed quickly to prevent the impact of falling rates from being amplified. While credit, payments and Net Interest Margins are likely to be the primary revenue impacts, no part of the bank will escape a widespread drop in demand that triggers a global recession.

- Customer Service and Advice Provision: Restrictions on personal interactions will push customers toward digital channels for service and sales. Most banks will keep branches open as a vital service. However, customers are being told to minimize in- person interactions and stay home, so many will look to manage their financial life through apps, online banking and greater reliance on their bank’s contact centre.

- Operating Model Adjustments and Cost Control: Misaligned revenues and cost will require banks to improve operational flexibility and rethink short-term priorities. Because of the cumulative impact of the pandemic-driven factors, there will inevitably be a misalignment of short-term costs and revenues in the banking sector for at least the next few quarters. As a matter of urgency, banks need to review and prioritize project expenditures and assess what can be slowed/ stopped and what can be redirected to initiatives with short-term impact, such as improving digital servicing capabilities or building a loan modification workflow for call centres.

Risks associated with the above impact areas include market risk associated with a sharp drop in interest rates and increased volatility in securities and FX price, counterparty credit risk with the current market events affecting counterparty credit profiles, non-financial risks such as conduct risk, culture and model risk, third party risk and cyber risk, risk governance, dividends and stock buybacks along with risks in credit ratings with market induced negative environment impacting banks and stakeholders, especially in the high-yield grade.

Operational resilience in crisis readiness, communications, monitoring and review, flexibility, quality and productivity is critical to overcome the crisis and be ready to address future crises.

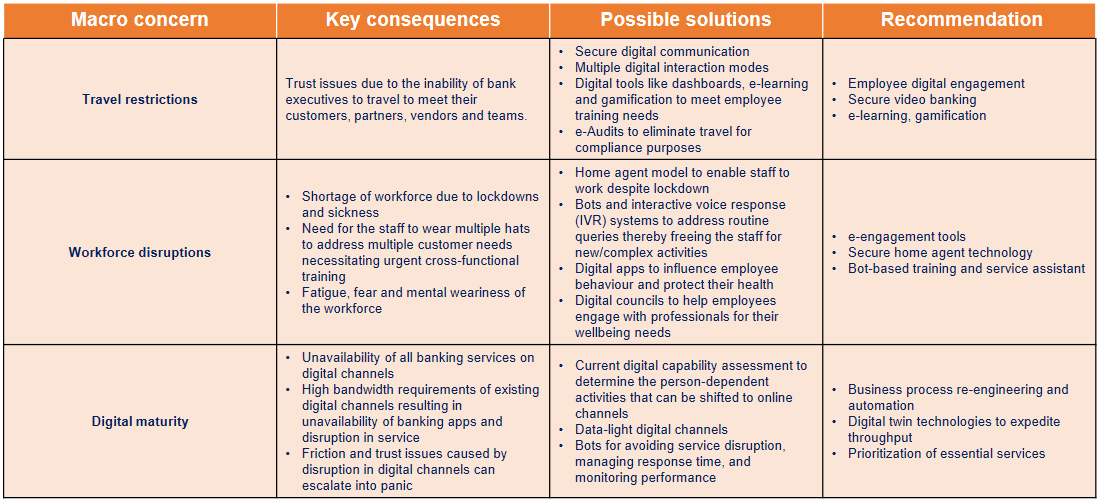

Impact Assessment and Recommendations (1/2)

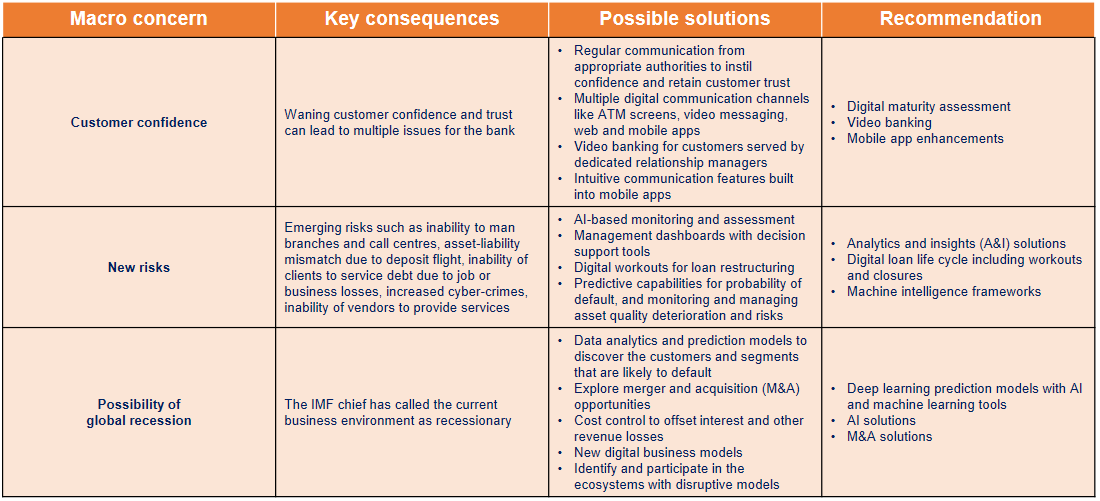

Impact Assessment and Recommendations (2/2)

Policy Relief for Reviving Economic Confidence

Flattening the curve of firm mortality must be the top policy priority, and governments need to expand the size and scope of support programmes over time. To prevent short-term liquidity problems from becoming solvency issues, governments must remain vigilant about the availability of funds for SMEs and larger firms as the crisis persists. Moreover, given that SMEs have short windows of cash on hand, programmes must be designed to ensure rapid disbursement of funds through simple, all-digital channels. As the economic crisis unfolds, it will be necessary for the government to provide support to so-far-excluded companies, such as middle-market firms lacking access to capital markets.

Governments, including regulators and central banks, must continue to coordinate policy on a global level to help maintain financial stability. Within countries, policy guidance must be clear and consistent across regulatory agencies. While regulatory policy within countries has generally moved in the same direction, in certain areas, regulators and supervisors are not sufficiently harmonized in their approach. Policy-makers should ensure that regulatory and supervisory changes are coordinated across the relevant domestic institutions to prevent confusion from limiting the effectiveness of policy action.

Policy-makers must ensure that the financial system remains capable of safely meeting the public’s need for financial services through digital channels. Given the need to quickly disburse

fiscal support to households and small businesses – in addition to the broader need to deliver financial services at a time when populations are being asked to socially distance – financial institutions must have leading digital capabilities. However, the crisis has so far exposed the variation in digital maturity among institutions.

In the short term, policy-makers should leverage the strengths of the entire financial system, including FinTech, to rapidly deliver support to small businesses and households. Moving forward, banks can explore partnerships with FinTech to quickly and safely introduce new products. Policy-makers should also encourage banks to continue to explore other technologies and partnerships that enable them to better serve digital-first customers and to operate in a more agile fashion. Given increased reliance on e-commerce and contactless payments, policy-makers should continue to explore technologies that enable fast, inexpensive, and ubiquitous payments through a resilient payment system.

Advanced economies may need to further expand the support offered to emerging markets and developing economies. Advanced economies have moved to increase their support to emerging markets and developing countries through both bilateral and multilateral channels; but, as the crisis in these countries unfolds, additional assistance may be required. Advanced economy policy- makers, as well as investors and financial institutions, must continue to develop and expand programmes to support these countries.

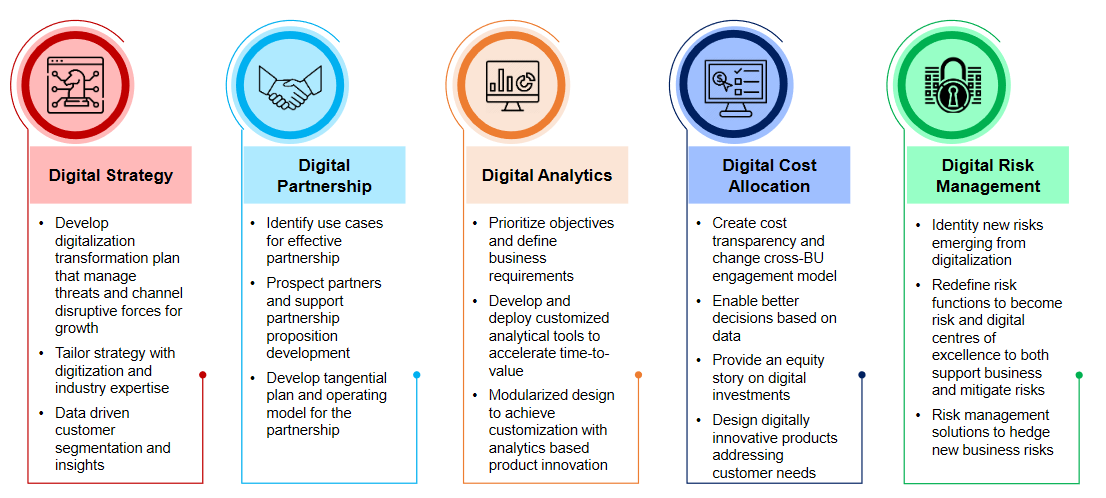

Digital Acceleration towards a Disruptive Operational Model

Industry Outlook – The Indian Perspective

Like any previous episode of economic slowdown, the most immediate fall-out of this pandemic was felt on the Financial Services sector. This is the reason why the Reserve Bank of India (RBI) came out with a Rs 3.74 trillion of support that enveloped most sectors. Additionally, the RBI cut the interest rate at which it lends to banks by 75 basis points. The other key measure announced was the forbearance on payment of instalments on all sorts of loans including farm loans. This will apply to all loans offered by regional rural banks, small finance banks and local area banks, co-operative banks, scheduled banks, and NBFCs (including housing finance companies and micro-finance institutions).

The measures are meant to ease disruptions in fund flows to real sectors of economy, avoid working capital shortage for businesses and stem panic withdrawals by households from banks and nonbanking deposit-taking institutions. The confidence building measures have also had a positive impact on outflows of capital by foreign institutional investors (FIIs) as well as drying up of external commercial borrowings. The move to reset working capital loans will particularly provide support to SME financing, averting significant distortion of supply chains.

Despite the RBI package, Indian banking and financial sector faces tough challenges in the coming months. Some sectors of economy such as travel, hospitality and transportation & logistics are badly hit. Credit exposure of commercial banks and nonbanking financial companies to those sectors may gradually turn into bad assets in the coming days.

The assessment of COVID-19-related dislocation in Indian financial sector can be studied from two angles: firstly, the channels that would perpetuate the risks already built up over the past few months, and secondly, the new challenges emanating from global economic shocks in the form of falling foreign direct investment (FDIs) and collapse of export revenues, remittance flows, etc.

Following the first strand, despite noticeable improvement in banking segment in terms of capital adequacy, liquidity and asset quality after seven years of deterioration, Indian banking is not entirely free from challenges. Overhang of NPAs and low credit growth by scheduled commercial banking indicates build up of risks in the system which may deteriorate further if cut in aggregate demand and business activity prolongs. The second channel of risks for Indian banking and financial sector is the contagion from faster transmission of global shocks.

All these developments would help aid the slowdown to worsen in a synchronized fashion thereby impacting commercial banking. Higher allocation of government expenditure towards fighting corona virus manifested in the form of medical supplies and health infrastructure would cut or postpone capital expenditure in other sectors to a great extent. In order to sustain efforts directed towards COVID-19, Indian financial sector needs to be prepared for tougher times in the coming days.

Reputation Challenges for the Industry

These are testing times and banks will need to quickly initiate measures to ensure seamless delivery of services to customers with minimal disruptions. Solutions that provide rapid or quick resolutions to the problems created by the COVID-19 crisis are the need of the hour. In most scenarios, short and crisp interventions must be initiated to carefully tread this slippery road. Navigating the COVID- 19 landscape will pose tough challenges to financial institutions, and collaborating with a trusted service provider is proving to be the way forward.

Reputational risks and opportunities have increased manifolds triggered by the uncertainties of Covid-19 pandemic for the BFSI enterprises.

There is an urgent need to consider the multiple near-, short-, and medium-term operational, financial, risk, and regulatory compliance implications. The situation has presented many opportunities to support market and economic activity and to facilitate a quick return to stability. If banks and capital markets firms respond well to these unprecedented challenges, they will not only help society, but also increase trust and the reputation of the banking industry in the long run.

cost of reputation risk is difficult, in part because it can arise as a consequence of other operational risks. A large number of firms especially the micro, small and medium businesses and also self- employed individuals are likely to default on their bank and NBFC loans. With these external challenges, Financial organisations ought to guard against reputation risks by a sizeable investment in process thinking and cultural improvements as they can result in huge losses to the institutions. Institutions should view risk management as an institutionalisation of best business practices, so as to anticipate risk events, minimise their impact and profit from it.

Areas of focus in reputation management could stem out of the existent operational capabilities and shortcomings, digital divide, customer demography ease of access and quality of service provided. There is a clear divide between established and emerging markets in the perceptions of digital versus traditional financial service providers where digital transformation has increased financial inclusion, one third of consumers believe digital providers are more trustworthy. In the digital age, data security and honesty are also leading concerns when engaging with financial services companies. It is imperative to create a culture of treating reputation risk seriously through integrity and collaboration.

Consocia Advisory, has been at the forefront of building and protecting organisational and brand reputation for several sectors.

We remain available to curate effective programs to pre-empt and mitigate risks through process-thinking, process-improvement and institutionalisation of best business practices, so as to anticipate risk events, minimise their impact and safeguard the overall future of the enterprise.

Cushioning the COVID impact on our clients: Consocia’s value driven services providing dynamic solutions

As COVID-19 grew into a global crisis, Consocia realized the need to support industry colleagues in dealing with the biggest challenge faced ever in recent times that of business continuity. In response to the situation, we were swift in curating an in-house crack team comprising experts in research and insights; stakeholder database generation; content; government relations and public policy.

Consocia Advisory engaged Central and State Governments besides many Districts through strategic narrative backed by data to highlight the need of the hour in the fight against the deadly pandemic. We urged immediate orders to restore Client’s ability to manufacture, warehouse, transport and distribute the client’s essential products across the country.

Presently, Consocia is working with several enterprises for business continuity as well as crisis management. In the last few weeks, we have helped opening of plants and warehouses of the Indian entity of a global disinfectant company in 6 states including in Red zones as well as

Containment areas, besides that of a renowned lighting solutions company in two states (Haryana and Karnataka) already while they are now looking for our assistance in three more states.

Within a few days of being on-boarded, through our 24×7 support, we were able to secure not only policy interventions for manufacturing but also for warehousing, logistics and distribution as well as access to staff & workers. In the process, we were able to assure the Central and State Government stakeholders that all due precautions are being taken to prevent and contain COVID 19. We even helped with internal SOPs for transportation and staff movement.

We are helping the apex body representing the Shopping Malls across India against the debilitating impact the Coronavirus pandemic has had on them. On behalf of SCAI, Consocia has crafted several interventions to draw the attention of the stakeholders and policy-makers on the plight of the industry and reinforcing reasons for Malls to be considered for resuming operations in a staggered manner, for the post-lockdown phase. At the same time, Consocia is working with the empowered Group of Ministers and Committees for COVID-19 response as well as the RBI seeking urgent financial stimulus for the sector and amplifying the initiatives through media engagement from time to time.

The upcoming editions of the dynamics of business transformation white paper series will focus on specific industries with strategies and outcome driven solutions to positively impact business outlook for business recovery and continuity in the COVID-adjusted world.

COVID-19 is a long battle for the industry. As your trusted well-wisher, our team is available to support you during these uncertain times in the areas of business continuity planning, public affairs, public policy and government relations. Contact us: reachus@consociaadvisory.com